reverse tax calculator bc

Current HST GST and PST rates table of 2022. See the article.

Current provincial sales tax pst rates are.

. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

The cumulative sales tax rate for 2022 in British Columbia Canada is 12. To use the sales tax calculator follow these steps. Reverse Tax Calculator For Bc.

For the first option enter the Sales Tax percentage and the Net. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST. Type of supply learn about what.

This total rate is a combination of a Goods and Services Tax GST of 5 and a Provincial Sales Tax. There are two options for you to input when using this online calculator. Reverse Sales Tax Calculations.

Current GST and PST rate for British-Columbia in 2021. If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. Here is how the total is calculated before sales tax.

The information used to make the tax and exemption calculations is accurate as of january 30 2019. The rate you will charge depends on different factors see. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Current GST and PST rate for British-Columbia in 2022. Reverse Tax Calculator For Bc. 04 pst on the purchase of energy products.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Reverse HST harmonized sales tax reverse calculator of 2019. Canada Sales Tax Chart Date Difference Calculator.

The following table provides the GST and HST provincial rates since July 1 2010. Here is how the total is calculated before sales tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

In the province of British Columbia your tax rate can be as low as 506 if your annual income is 43070. Current GST and PST rate for British-Columbia in 2020. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. Provinces and territories with gst.

Tax rate for all canadian remain the same as in 2017. Tax rate for all canadian remain. Most goods and services are charged.

55 if manufactured modular home. And as high as 205 if your income is over 227091. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

That means that your net pay will be 38554 per year or 3213 per month. The information used to make the tax and exemption calculations is accurate as of january 30 2019. If youre looking for a reverse.

Provinces and territories with gst. Reverse Sales Tax Rates. This reverse tax calculator will help you to know the.

Sales Tax Calculator Vat Gst Amazon Ca Appstore For Android

65000 Income Tax Calculator British Columbia Bc Canada 2020

Chip Reverse Mortgage Rates Homeequity Bank

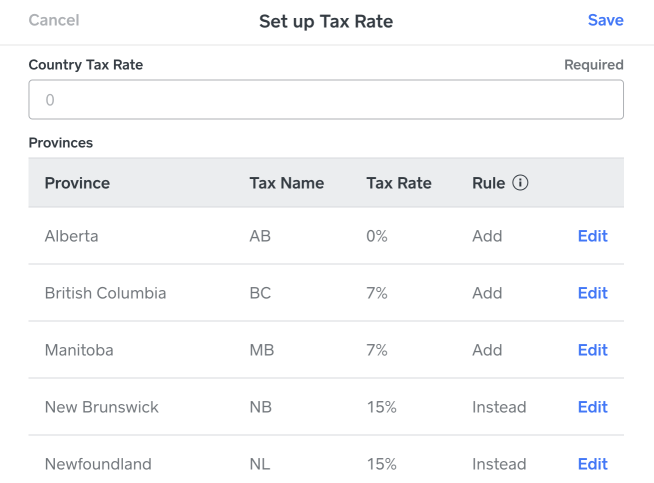

Create Tax Rates Weebly Support Us

Reversing Date Calculation In Dynamics 365 Business Central

How To Calculate Sales Tax In Excel

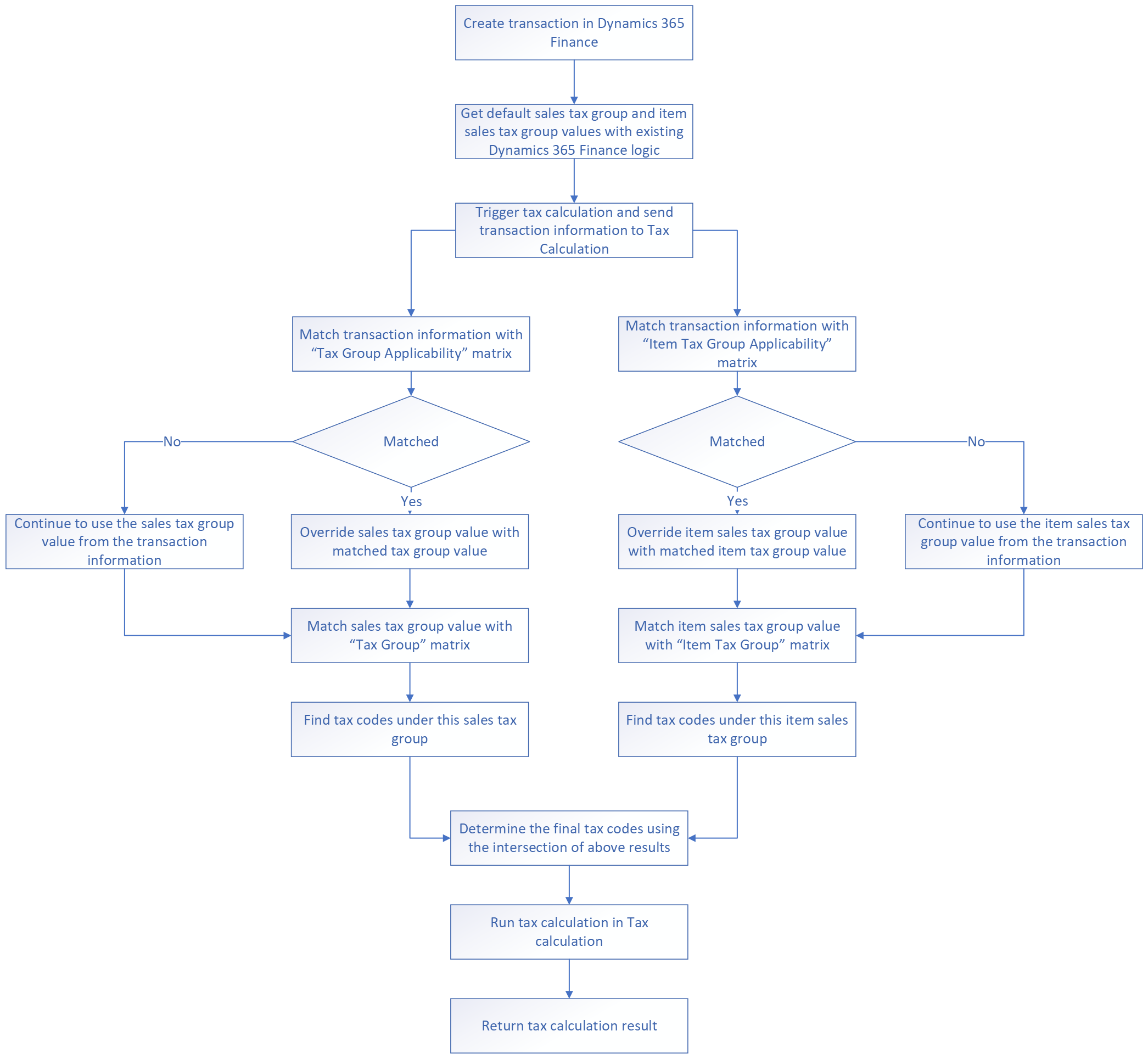

Get Started With Tax Calculation Finance Dynamics 365 Microsoft Learn

Reverse Mortgage Calculator A Convenient Tool Homeequity Bank

Canada Capital Gains Tax Calculator 2022

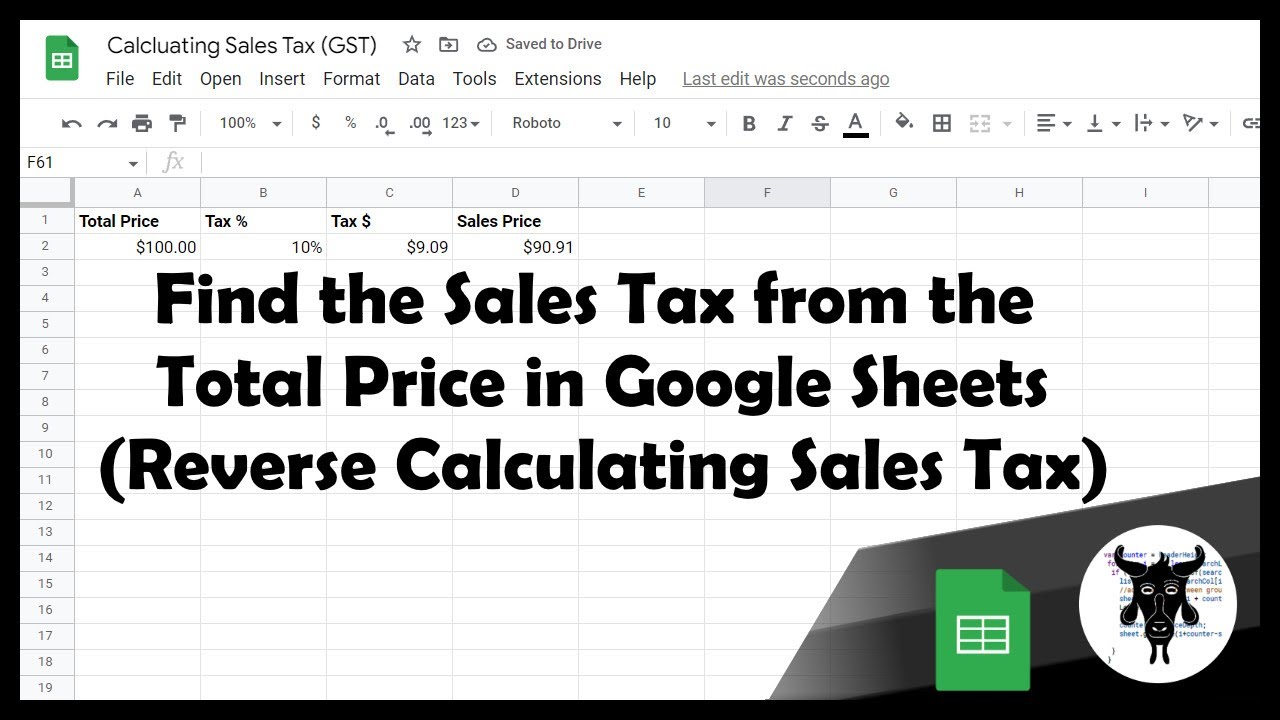

How To Easily Calculate Sales Tax Gst In Google Sheets Yagisanatode

Property Tax Calculator Smartasset

How To Adjust Your Dynamics Gp Solution To Reflect The Reduced Rate Of Vat

Business Guide To Pst In British Columbia

How To Calculate Sales Tax In Excel

Tax Calculator British Columbia Kuoot

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com